As the economic effects of Covid19 reverberate around the world, it is clear that there will be an impact on credit scores, and that impact will be felt differently in developed and emerging markets.

“LenddoEFL has always, since inception, focussed on emerging economies. Fundamentally, we take alternative data sets and we use them to build credit-risk models for areas of the markets that don’t have traditional credit bureau scores. And we do this in markets where there are no credit bureaus, or where the bureaus only cover 10 - 30% of the market.

In developed markets, credit-bureaus already exist, generating scores for financial institutions which are used to make credit-risk decisions based on historical repayment behaviour. But there is suddenly an unprecedented spike in unemployment - we’re seeing upwards of 20 million people in the US alone and the numbers are climbing - and that’s the same in many countries.

We’re in an interesting dynamic now. Lockdowns are having a real impact on consumer income and we could be in a place where we see a ‘black-hole’ as it relates to credit-scores.

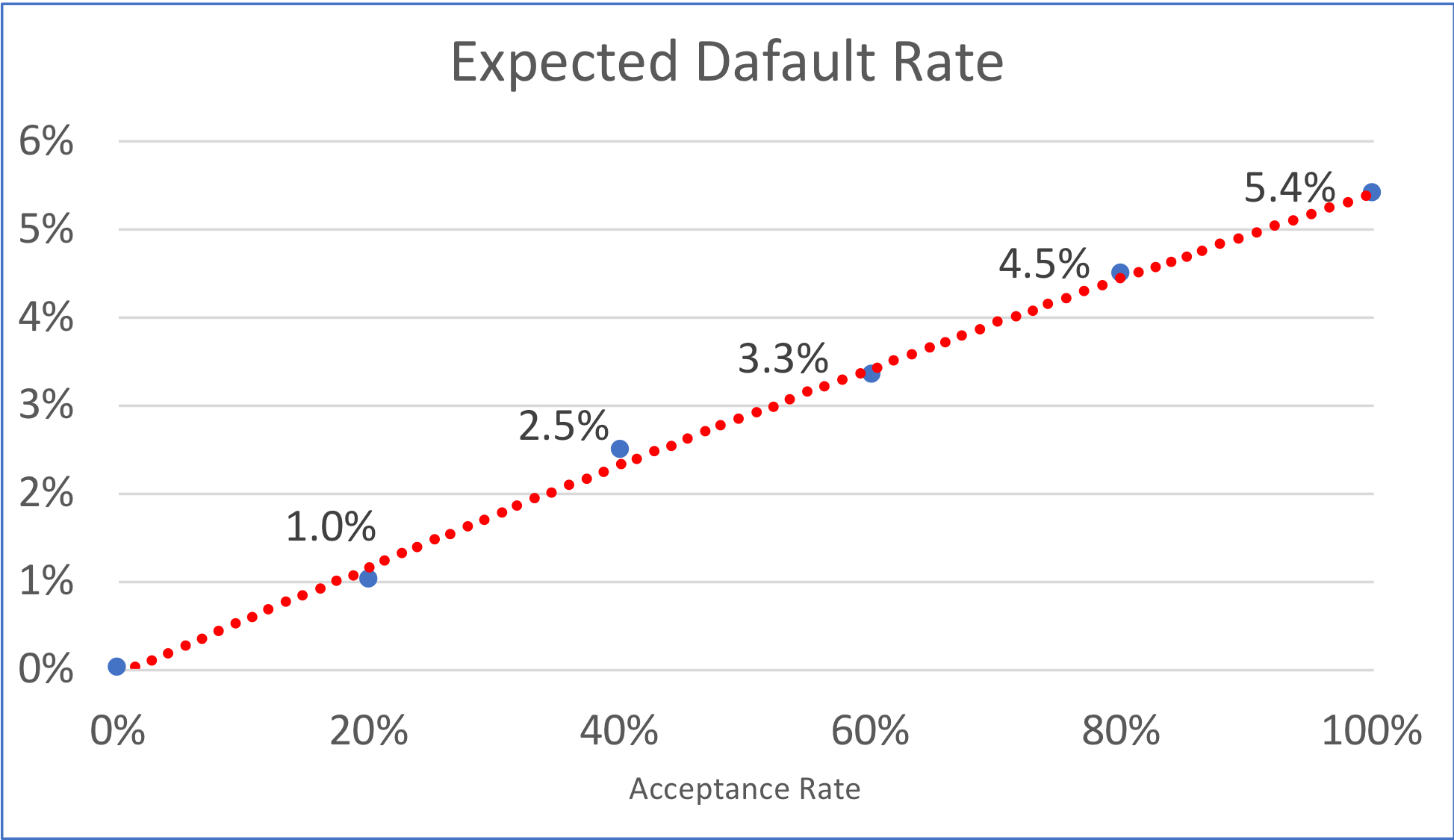

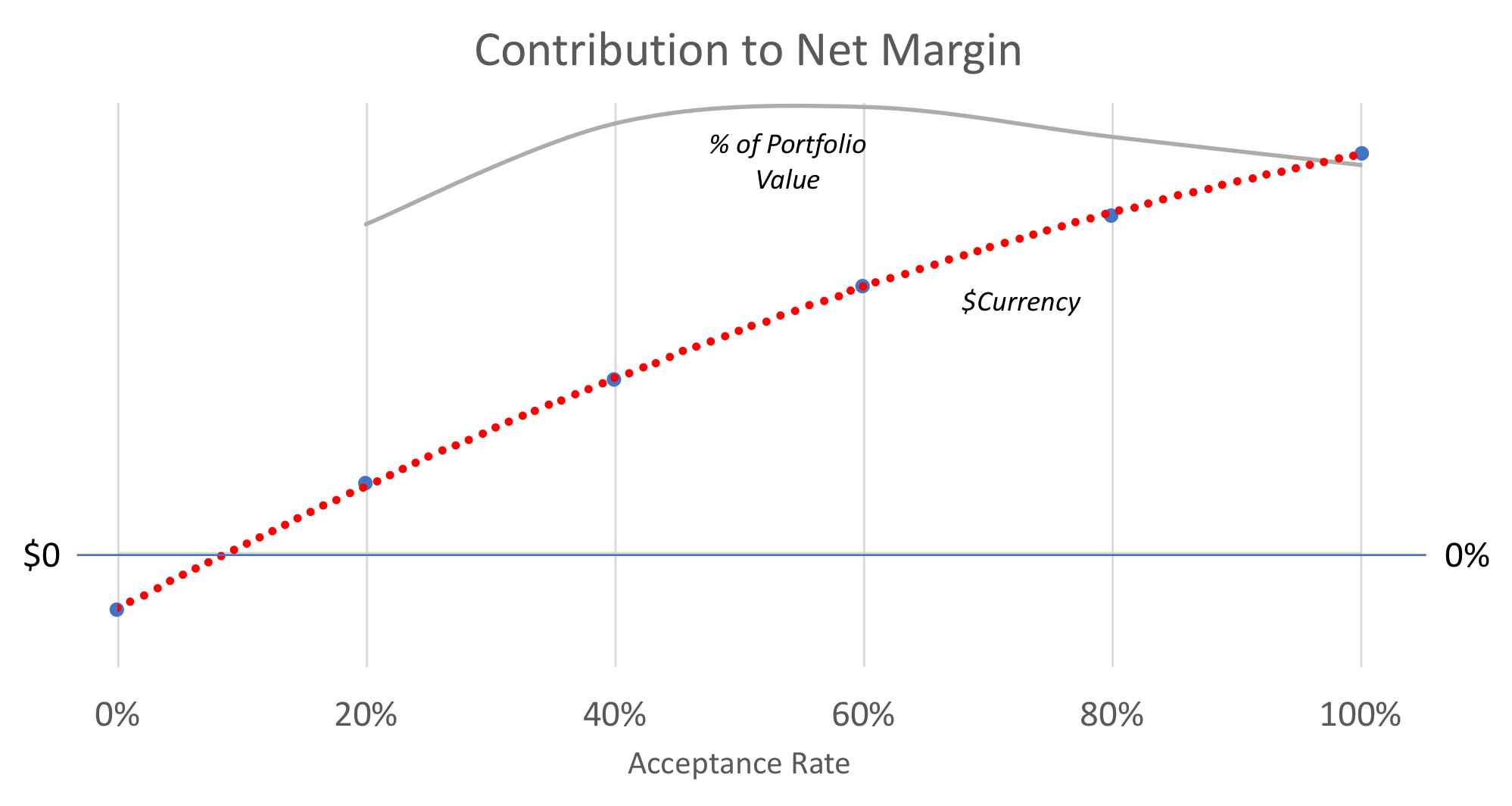

There is a massive change in the market. People’s lives have changed, very unexpectedly. And, sooner or later, we are going to see a spike in defaults. And at a certain point, this unexpected event will damage traditional credit-risk scores.

When the economy does start to restart, and when the governments do start encouraging banks to lend again, they will go to the credit bureau to ask for credit-scores on borrowers, and they are going to get a lot of challenging results.

At LenddoEFL, we do believe that this pandemic will see a lot of financial institutions push towards new digital solutions. Banks have been encouraging their users for some time to embrace digital solutions, online banking. Well now those branches are closed and people are picking up online banking in a way they haven’t before. And that’s a positive thing.

We think there will now be an increased reliance on using new sources of data; such as social data, mobile phone data, psychometric data etc. These data sets are going to be increasingly important in predicting someone's repayment behaviour following this anomaly of significant default that is coming.

In a developed market, someone who had a perfect credit score might soon have a 3 month gap.

Additionally, in these western markets, where governments are providing relief, there is the possibility they are ‘kicking the can down the road’ and consumers are going to be faced with some type of ‘balloon payment’ in the coming months which could be insurmountable.

In an emerging market, we look at people who have no credit score, and LenddoEFL solutions can generate a score for them.

At LenddoEFL, one of the things we do is, we look at behavioural science. We look at the behaviour of the individual at a snapshot in time - now - and use that behavior to predict the repayment of an individual. We look at thousands of data points from different sources to bring out significant information that historical repayment data doesn’t show.

The pandemic is creating a great opportunity for emerging economies to take a step forward. There is going to be capital available to be deployed. At LenddoEFL, we have seen that in emerging markets there is a greater acceptance of these types of new solutions. Emerging markets have the opportunity to push harder and faster to get out of this.”

Photo by Gabe Pierce on Unsplash