LenddoEFL collaborated with the World Bank Group to facilitate psychometric assessment for alternative credit scoring as part of the Women Entrepreneurship Development Project (WEDP) launched by the Government of Ethiopia.

The World Bank recently published an extensive and insightful report: “Designing a Credit Facility for Women Entrepreneurs Lessons from the Ethiopia Women Entrepreneurship Development Project (WEDP)”, which delves into different aspects of this project.

To download the full report please visit: https://openknowledge.worldbank.org/bitstream/handle/10986/34013/Designing-a-Credit-Facility-for-Women-Entrepreneurs-Lessons-from-the-Ethiopia-Women-Entrepreneurship-Development-Project.pdf?sequence=4

WEDP was launched in 2012 by the Ethiopian government with the aim of increasing the earnings and employment of growth-oriented micro and small enterprises (MSEs) owned or partly-owned by women entrepreneurs in Ethiopia. LenddoEFL was selected to

Following are selected extracts from the World Bank Report regarding LenddoEFL’s contribution

From Page 11 of the Report:

“WEDP provided a stable anchor from which to innovate, including drawing on financial technology (fintech) as a means to maximize the operational efficiency and effectiveness of lenders, while relaxing collateral constraints for women entrepreneur borrowers. The success of introducing a non-traditional credit assessment methodology to a low-tech and low-literacy environment like Ethiopia stirred enthusiasm and buy-in from the financial sector.

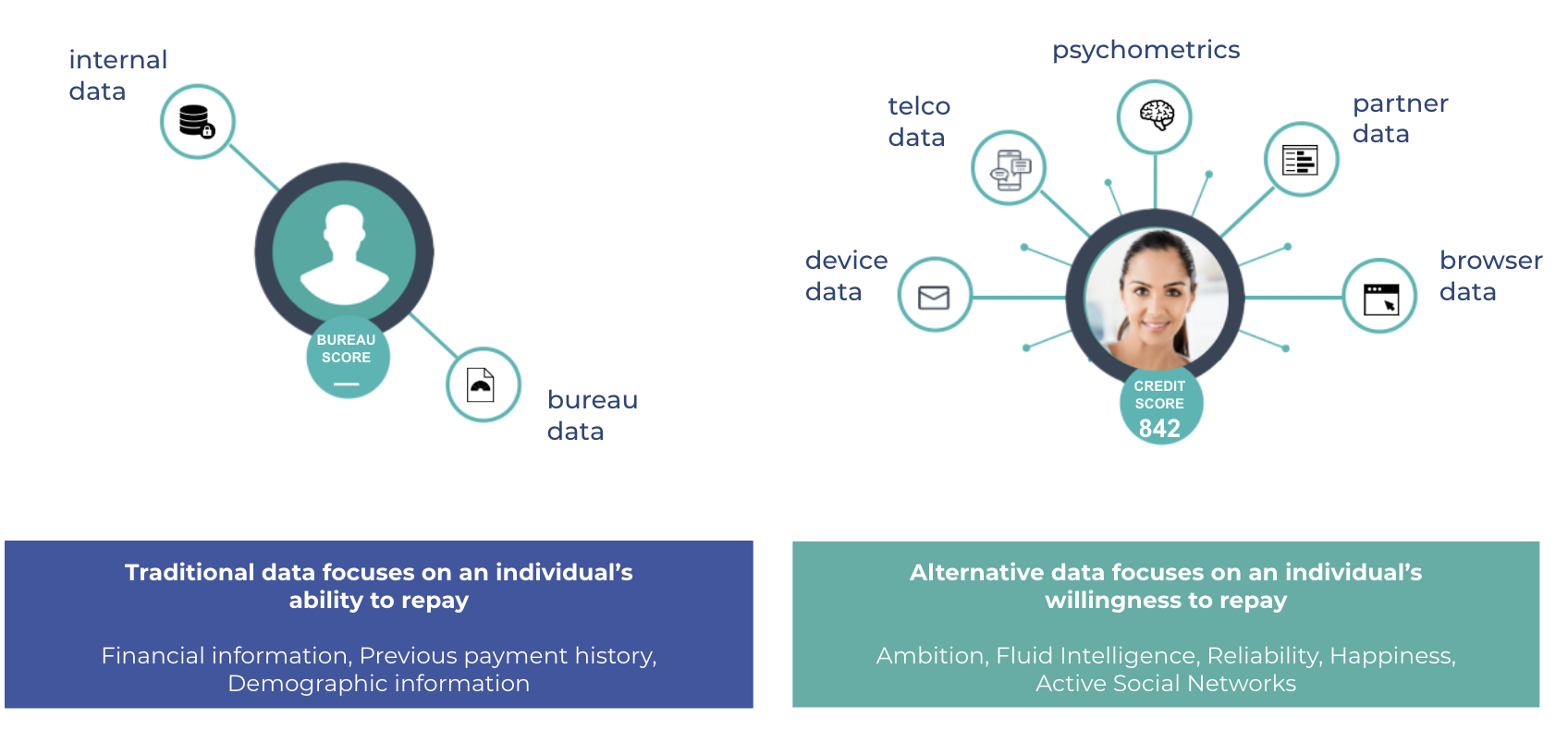

Financial institutions’ traditional lending methodologies often require data on loan applicants, including their tax records, credit history, financial statements, and legal status. MSEs in general, and women-owned MSEs in particular, often lack sufficient credit history, reliable financial statements, and collateralizable assets. This is compounded in emerging markets like Ethiopia, where there is an absence of proper financial sector infrastructure, such as a credit information system, which can help lenders identify credit-worthy borrowers. Faced with such limitations, financial institutions rely on unduly large collateral requirements to minimize their exposure and risk. This results in many women-owned MSEs being excluded from the financial system, while financial institutions miss the opportunity to tap into a pool of potential borrowers.

In recent years, there has been a tide of financial technology, or “fintech”, that has been sweeping across the global financial landscape, which has introduced new tools, systems and business models — allowing financial institutions to accelerate MSE lending in a profitable and cost-effective manner. In early 2014, the WEDP team began investigating different technologies that could address the collateral constraint by closing the information gap among MFIs. Among the promising technologies was one developed by the Lenddo Entrepreneurial Finance Lab (LenddoEFL), whose approach does not rely on traditional financial statements, business plans, high-value physical assets, or borrowing histories. Rather, their value proposition was a universal credit score that was calculated based on a psychometric tool that evaluates the entrepreneur’s personal attributes, including “locus of control, fluid intelligence, impulsiveness, confidence, delayed gratification and conscientiousness.” LenddoEFL’s technology allows for an applicant to complete a 45-minute self-administered test on a tablet computer to determine his or her eligibility for a loan. While this technology had been used in other contexts to help banks improve and/or expand their portfolios, WEDP was among the first initiatives to harness this technology as a substitute for fixed asset collateral. Moreover, for those applicants who already had collateral, the test was designed to allow them to qualify for a larger loan size.

To pilot the psychometric testing, the Amhara Credit and Savings Institution (ACSI) was selected, as it is the largest MFI in the country, with over 1 million active borrowers, 440 branches and individual loans comprising 10 percent of its portfolio. ACSI saw the LenddoEFL technology as an opportunity to improve their ability to screen for individual loans even beyond their WEDP portfolio.

Despite EFL’s great track record in Sub-Saharan Africa, Ethiopia’s context presented a unique challenge. In addition to translating the test into Amharic, LenddoEFL worked to include more visuals and interactive exercises to cater to ACSI’s low-tech and low-literacy clients. Moreover, while ACSI was enthusiastic about the psychometric testing, it was understandably hesitant about relying too much on the technology, given the lack of an evidence base in Ethiopia. As such, EFL focused on testing clients without using the resulting score as the basis for the credit decision – allowing ACSI to observe the accuracy of the test without taking on any credit risk.

In 2015, the psychometric test was pre-piloted in two ACSI branches in Bahir Dar with 420 interested clients, and then piloted across 12 branches with 2,496 clients. As loans matured, WEDP was able to track the progress of the loan repayments. The data revealed a clear trend between psychometric test scores and loan performance. Those borrowers who scored higher on the test were seven times more likely to repay their loans than lower scoring customers. Further results and details of the study are available starting on page 45.

“Having succeeded with one of Ethiopia’s largest financial institutions, the pilot demonstrated that a psychometrics-based loan screening system could be developed in the country, pushing the frontier of credit access for hundreds of thousands of collateral constrained borrowers. The ACSI experience demonstrated to policymakers and private sector leaders alike that fintech can make a profitable and profound difference to the Ethiopian economy. ”

Based on the proof-of-concept from the ACSI pilot, other MFIs began requesting for the psychometric technology. In 2018, WEDP launched the LenddoEFFL screening system with Wasasa. In 2020, ADCSI followed suit. Around this time, as an added incentive, DBE began providing additional liquidity (named “WEDP X”) to support MFIs who were eager to test out alternative collateral products. Moving forward, WEDP is likely to build on this incentive mechanism to facilitate further crowding in by other microfinance institutions across Ethiopia.”

Source: The World Bank

Header photo by Stéphane Hermellin on Unsplash