LenddoEFL has been featured by leading FinTech consultants, Mondato, in their Insights Series.

Know Your Customer — often abbreviated as KYC — is such an important part of success in digital finance that it almost deserves to be canonized into KTC: Know Thy Customer. Indeed, creating “bank-legible” forms of identity authentication, streamlining methods of verifying it, and tailoring business strategies around it — all of these entail an enormous range of regulatory and business challenges, from data privacy to algorithmic discrimination. In evaluating the promises of alt-data for banking thin-file customers, this week’s Insight explores the promises and perils of psychometrics as a way of evaluating would-be lendees.

Know Thy Customer

The first maxim adorning the mythical Delphic Temple of Apollo in Ancient Greece, famously, is “Know Thyself.” In business, however — particularly in the business of lending — it is easy to see why the first law may rather be ‘know thy customer.’ In the US, knowing who to lend to was revolutionized in the 1950s when an engineer and a mathematician teamed up in California to generate the first ‘credit score’ — today known as a FICO score — factoring a number of data points around payment history, amounts owed, length of credit history, types of credit used, and more.

The success of this system spread throughout much of the world, and though the precise ways in which each national jurisdiction has developed or regulated credit scoring varies significantly, the art of recouping loans has become much more of a science: the science of quantifying a specific individual’s likelihood to repay a loan under a given set of assumptions or circumstances.

Here, traditional credit bureaus (think EquiFax, Transunion, and Experian in the US) have historically played a major role in the development of retail bank credit. The World Bank deemed the model good enough for export, and has been promoting the development of private credit bureaus in emerging markets since 2001. The record, evaluated by any number of dimensions, is mixed at best; as of 2019, private credit bureaus cover just a third of adults globally, with gaps in coverage unsurprisingly concentrated in lower-income countries.

Indeed, while such forms of credit assessments (for better or for worse) lie at the center of retail finance in formal economies, the paradigm presents serious challenges in emerging markets. Given the paucity of ‘bank-legible’ financial histories in the informal sector, would-be loan applicants in Africa, Asia, or Latin America seeking a loan from a traditional bank might find their hopes and dreams of home-ownership or entrepreneurship at the mercy of a faceless bank bureaucrat judging their ‘worthiness’ on nothing but their gut — or, worse, their biases and stereotypes.

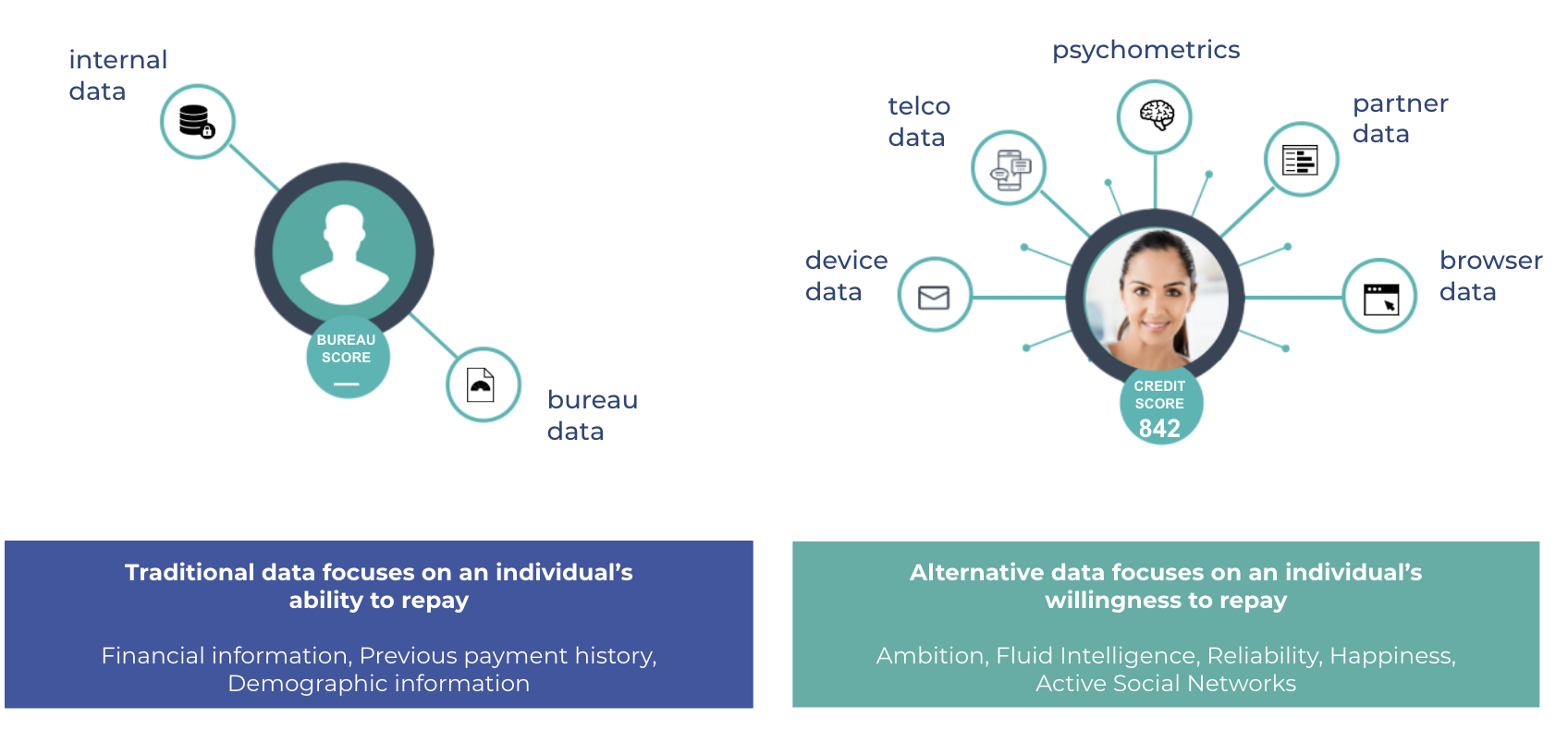

Enter alt-data. The digital era has spawned entirely new forms of understanding people’s behavior through the combination of new forms of data generation and algorithms that can identify hidden correlations between ‘user attributes’ and payment outcomes. In other words, given the appropriate data inputs on an individual and the larger population — as well as judicious interpretation — big data and machine learning can yield actionable, predictable outcomes.

But from whence is this alt-data mined, and is it reliable? Our phones, naturally, can provide a ready trove of information about us, and given their ubiquity even among the world’s poorest, they’re increasingly being leveraged for purposes both benevolent and nefarious. Same goes for satellite data — like all powerful tools, they are double-edged.

Source: UC Berkeley Center for Long-Term Cybersecurity, 2020

Psychometrics, however, are fundamentally different from other alt-data sources in at least two ways: firstly, there are less privacy concerns since psychometric data can only be collected with the potential lendee’s consent — and without the use of labyrinthine terms and conditions agreements that often obscure data mining operations — given that they are administered as a questionnaire. Secondly, while not everyone has a cell phone or uses it extensively, everyone’s got a personality.

Alt-Data Streams of Consciousness

Psychometrics occupy a particularly sensitive — and almost mystical — place among sources of alt-data. This is due, at least partly, to the fact that the entire field of psychology has sustained fundamental challenges in recent years. Against a canonical understanding of “homo economicus” as a utility-maximizing rational actor, the sub-discipline of behavioral economics has been gaining traction as a more rigorous way of understanding, predicting and even influencing human behavior.

Similarly, the past few years have uncovered a systematic bias among swathes of psychology experiments that universalize generalizations drawn principally from studying populations in Western, Educated, Industrial, and Democratic — aka WEIRD — countries.

““Decades of psychological research designed to uncover truths about human psychology may have instead uncovered truths about a thin slice of our species — people who live in Western, educated, industrialized, rich, and democratic (WEIRD) nations.””

Meanwhile, pop-psychology theories further invite skepticism, like the infamous “Color Test.” Such tests aim to simplify personality traits into neat, discrete and stable categories, purported to determine romantic, amicable or professional compatibility between individuals. Even popular tests like the famous Myers-Briggs Test, however, mostly fail to stand up to snuff when the empirical rubber meets the road of statistical significance — for most Human Resource departments, the most charitable assessment of such tests has been summarized as “not entirely useless.”

But psychometrics for credit-lending deserve a hard look, if for no other reason than the endurance of LenddoEFL in the marketplace.

LenddoEFL is perhaps the oldest and best known outfit providing psychometric credit scores. The product of a merger between Harvard research-incubated Entrepreneurial Finance Lab and Lenddo, a Singapore-based smartphone data credit specialist, the two companies joined forces in 2017 and claims to have facilitated over two billion dollars in loans across the more than 20 countries in which it has operated. Its proprietary tests are broadly based on the most rigorously evaluated psychometric frameworks in academia: the “Big Five” personality traits of extraversion, conscientiousness, agreeableness, neuroticism and openness to experience.

The case for psychometrics qua credit-scoring, however, has a fairly major bona fide when it comes to evaluating loan-performance: market proof. An independent World Bank evaluation of a LenddoEFL collaboration with Superintendencia de Banca y Seguros (SBS, the fifth largest commercial bank in Peru) using data from June 2011 to April 2014, concluded that psychometric scores were indeed practicable for identifying ‘good lendees’ that traditional assessments would otherwise pass on:

““Banked applicants accepted under the traditional credit scoring method but rejected based on their EFL score are 8.6 percentage points more likely to have been in arrears for more than 90 days during the 12 months after being screened by the EFL tool, compared to 14.5 percent of entrepreneurs who are accepted using both methods … results suggest that the EFL tool can be used to offer loans to unbanked applicants who are rejected under the traditional method without increasing the risk of the loan portfolio.””

The evaluation is narrow in its findings, but it lends strong evidence that rigorously developed psychometric tests are able to add a layer of KYC granularity in identifying individuals who are both able to generate enough cash flow to service their debt and who are willing to repay their debt.

All Data is Credit Data

While an increasing number of financial institutions and fintech players are learning to integrate alt-data feeds into their KYC processes, psychometrics remain an edge case. Nonetheless, a handful of psychometric providers have gained traction around the world, like Innovative Assessments based out of Israel (though with a large global footprint), or GFI, focused on the Malay market. A commonality across psychometric providers appears to be founders with a long and established track record in academia and social science research methods. This perhaps explains why there aren’t more psychometric companies out there; amidst the aura of mind-reading in a psychometric business pitch, investors are typically reassured that the product is literally built by a PhD holder. However, these are not necessarily the individuals known for building and scaling companies and products.

James Hume and Jabu Sithole, respectively the Chief Operating Officer and Head of Modelling at LenddoEFL, reflect on this particular challenge in their own company’s history. They note that the secret sauce in creating a successful psychometric-for-lending business is not in understanding or quantifying ‘personality’ per se, but rather in ruthlessly testing correlations within data sets comprised of carefully collected character attributes, and — critically — intelligence on ‘bads,’ or lendees who default on their obligations.

““The key is to ask the right question. Our primary driver is not to understand personality. We are laser focused on correlations and predictability, specifically around repayment.””

““When we ‘train the model,’ what we are doing is using historical data to decipher historical patterns and project into the future. But if you lack ‘bads’ in certain segments you examine, then it’s hard to get a sense of who will default. So to begin with, we need sufficient sample size and representativeness, and different characteristics to generate confidence. This can take time — between 6-9 months.””

This process necessarily entails a learning curve for each new market — after all, no one is claiming that Nigerians who score the same on questions testing conscientiousness or confidence will behave the same way as Chinese applicants with the same scores. But part of the secret sauce also comes with measuring how people answer, not just what they answer.

Indeed, the time an applicant spends on a question can itself provide an additional data point to feed into the credit-algorithm. Mondato has previously explored how such “autogenic” data processing techniques have proven effective in predicting who will churn in an IFC-Mastercard report on account dormancy last year, and it perhaps bears repeating that when it comes to machine learning for human behavior, human decision-makers often need to relinquish the “need to understand in order to satisfy the need to predict.”

Personality as Product?

So if personality traits can reliably be measured in ways that can help the unbanked gain access to credit, why haven’t such tools become ubiquitous? For starters, there is still a lot of market education to be done. Traditional models are already fairly good at identifying great loan applicants and terrible ones; it’s in the segment of ‘average’ lendees, or those at the margin, that there is the most room for improvement — and most banks don’t even make most of their profits through retail lending in the first place. Incrementally improving their lending models — while improving financial inclusion — is not going to rock their bottom lines, and thus creates significant bottlenecks to uptake.

Secondly, ‘productizing’ alt-data for lending is still a relatively niche use-case. While the idea holds a lot of promise, particularly as digital identities become more and more critical to long-term customer relationships, a profitable business model for offering B2B alt-data credit scoring is yet to be fully cracked. Simply put, developing and incessantly refining behavior-predicting algorithms isn’t free, nor is it cheap.

Subsequently, LenddoEFL recently simplified its pricing model, lowering upfront engagement costs in favor of recurring service charges. The gamble is that the service can provide value to lenders immediately (for example around cross or upselling opportunities) and on an ongoing basis, rather than charge a big lump-sum up-front for a model that only starts to yield fruit in half a year. In this way, it hopes to generate more value to clients and more revenue streams for itself even before the full repayment picture needed to calibrate the model for its primary purpose — identifying ‘invisible good bets’ — is even completely baked.

Nestled at the heart of “alt-data for inclusion” narratives are fundamental ethical questions. As researcher Rob Aitken reminds us, inclusion projects often constitute troubling new kinds of social sorting and segmentation:

““Experiments in alternative credit scoring are, in some essential measure, attempts to know the unbanked – to know unbanked bodies, payment traces, psychological inclinations, online behaviour, social footprints – and to verify the creditworthiness of those bodies in detailed and intimate ways. The body becomes itself a kind of ‘database’ from which some sort of content is extracted or “captured,” then algorithmically encrypted and sorted for retrieval.””

In lightly regulated environments, consumer protections are all the more important, particularly given the ominous implications of racist, sexist or neocolonial artificial intelligence. And yet, hope remains that models will evolve that put people in charge of their own information, and in this sense psychometric evaluations may represent a uniquely powerful modality of respecting unbanked or underbanked individuals’ privacy, dignity and agency. Can we imagine a future where all consumers will be empowered not only to control and protect their data, but perhaps even to monetize it according to their own needs, desires, freedoms or aspirations? Perhaps the first seeds can be found in tools that allow people simply to learn as much about themselves as others are collecting. The Oracle at Delphi, surely, would agree with this virtue.

Photo by The New York Public Library